The banking industry has humbly acknowledged the increasing significance of mobile applications 📱🏦. Let’s explore the reasons why they have become indispensable tools for banks and customers alike, catching the attention of higher-level management.

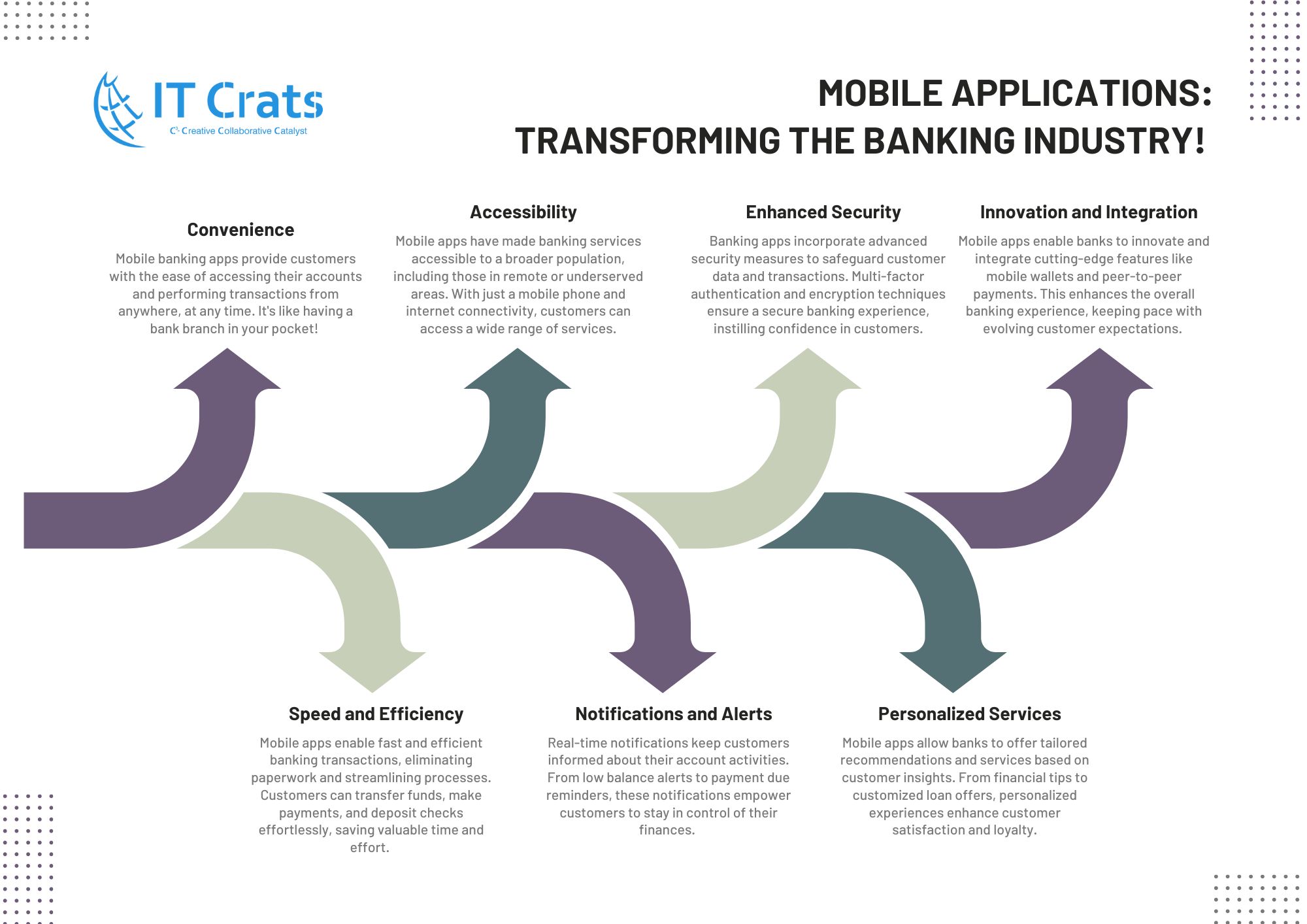

🔹 Convenience: Mobile banking apps offer customers the ease of accessing their accounts and conducting transactions from anywhere, at any time. Users can effortlessly check their balances, transfer funds, pay bills, and manage their finances on-the-go, eliminating the need to physically visit a bank branch.

🔹 Speed and Efficiency: With mobile banking applications, customers can swiftly transfer funds between accounts, make payments, and even deposit checks using their mobile devices. This streamlined process saves valuable time and eliminates paper-based procedures such as form-filling and writing checks.

🔹 Accessibility: Mobile banking apps have opened up banking services to a larger population, including those who may not have convenient access to physical bank branches. With a mobile phone and internet connectivity, customers can enjoy a wide range of banking services, even in remote or underserved areas.

🔹 Notifications and Alerts: Real-time notifications and alerts provided by mobile banking apps keep customers well-informed about their account activities. These alerts cover low balances, fraudulent transactions, payment due dates, and other crucial updates. Such proactive notifications empower customers to remain in control of their finances and take immediate action when necessary.

🔹 Enhanced Security: Banking applications prioritize the security of customer data and transactions by implementing advanced security measures. These may include multi-factor authentication, biometric authentication (such as fingerprint or facial recognition), and encryption techniques. By utilizing these applications, customers can trust in the security of their financial information.

🔹 Personalized Services: Mobile banking apps enable banks to offer personalized services tailored to individual customers. By leveraging data analytics and customer insights, banks can provide customized recommendations such as financial management tips, investment options, or loan offers. This level of personalization enhances the overall customer experience and fosters stronger relationships between banks and their customers.

🔹 Innovation and Integration: Mobile applications empower banks to innovate and seamlessly integrate additional features and services. They can introduce cutting-edge technologies like mobile wallets, peer-to-peer payments, or digital personal finance management tools directly within the app. These integrations enhance the overall banking experience and provide customers with a comprehensive solution for their financial needs.

The use of mobile applications has unquestionably revolutionized the banking industry. They have become a humble, efficient, and secure means of accessing banking services, driving the digital transformation of the financial sector. 🌟💻🏦

#MobileBanking #DigitalTransformation #FinancialSector #Innovation #Convenience #Security #Accessibility