Today, we want to share my knowledge and experiences, focusing on the key factors to consider while designing scalable architectures for banking and insurance applications. 🏦🔒

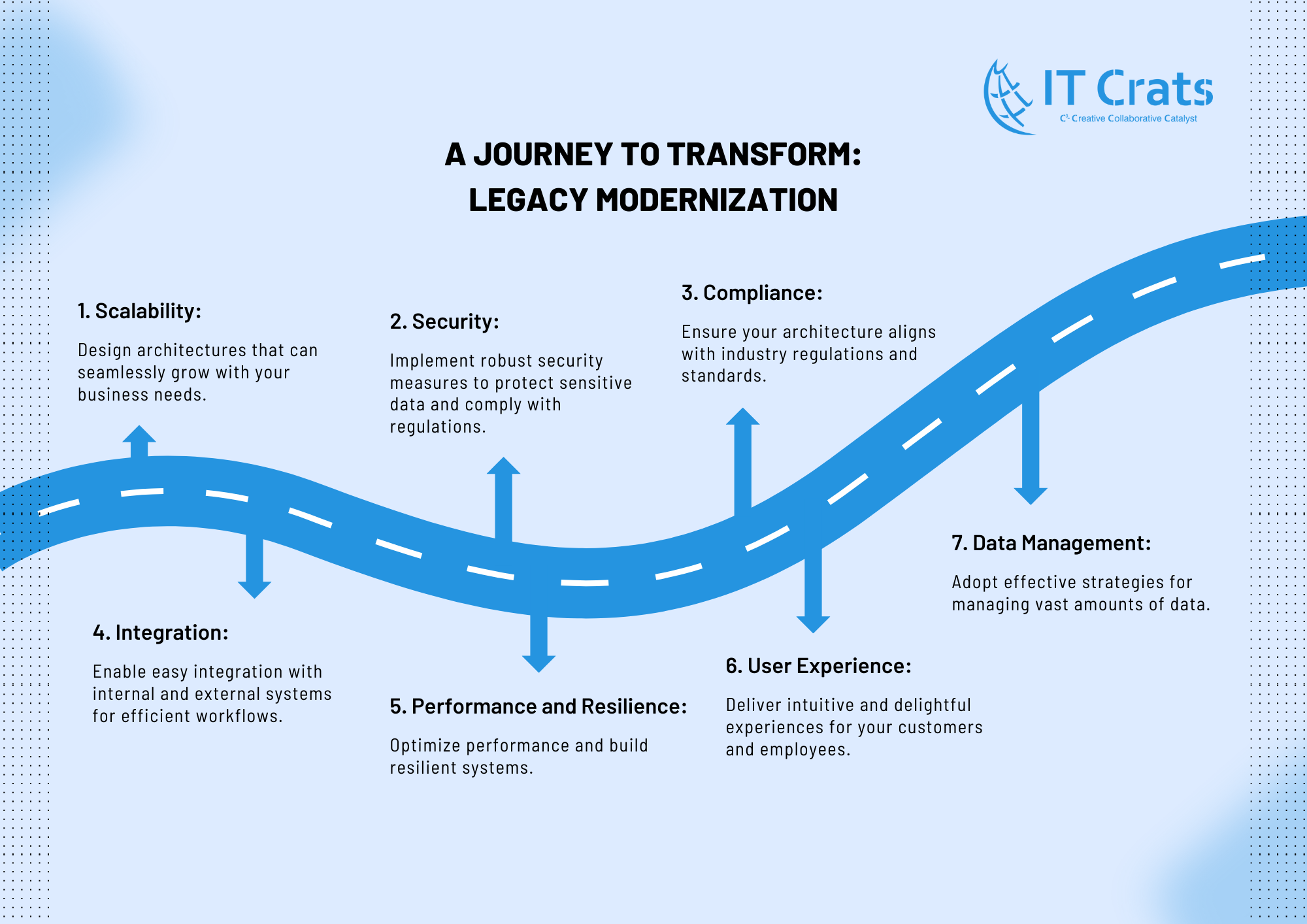

1️⃣ Scalability: The foundation of any modernization effort lies in designing scalable architectures. Imagine building a high-rise building with a strong foundation that can accommodate additional floors as the need arises. Similarly, a scalable architecture should allow seamless expansion to handle increasing workloads, user bases, and changing business needs. By employing scalable solutions, such as microservices or cloud computing, you can ensure your application is equipped to handle future growth. 📈💪

2️⃣ Security: In the realm of banking and insurance, security is paramount. Just as you lock the doors to your home, it’s crucial to implement robust security measures to protect sensitive customer data, financial transactions, and comply with regulatory standards. Employing encryption, secure authentication mechanisms, and adhering to industry best practices will shield your applications from potential threats, ensuring your customers’ trust remains intact. 🔒🔐

3️⃣ Compliance: The banking and insurance sectors are highly regulated industries with stringent compliance requirements. When modernizing legacy systems, it’s essential to consider these regulations and design architectures that seamlessly integrate compliance controls. Ensure your architecture adheres to standards such as GDPR, PCI-DSS, HIPAA, or any other relevant regulations to avoid potential penalties and reputational damage. 📜✅

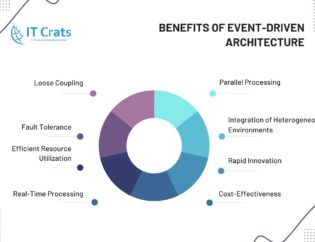

4️⃣ Integration: Legacy systems often lack the ability to seamlessly integrate with modern technologies, hindering efficient workflows and data sharing. While modernizing, it’s crucial to design architectures that allow easy integration with other systems, both internal and external. By embracing open standards, APIs, and leveraging technologies like service-oriented architecture (SOA) or event-driven architecture (EDA), you can unlock the potential for streamlined data flow and improved collaboration. 🤝💻

5️⃣ Performance and Resilience: Banking and insurance applications are expected to deliver optimal performance and maintain high availability. To achieve this, it’s vital to design architectures that prioritize performance optimization, such as efficient data caching, load balancing, and horizontal scaling. Additionally, implementing fault-tolerant measures, like redundancy, data replication, and disaster recovery strategies, ensures your systems can withstand any potential disruptions. ⚡🛡️

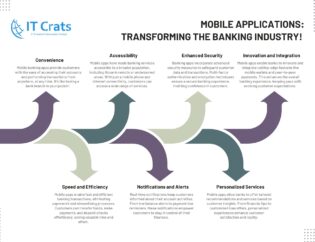

6️⃣ User Experience: A modernized application should provide an intuitive and delightful user experience. Consider the needs of both customers and employees when designing user interfaces. Incorporate responsive design principles, accessibility features, and seamless multi-channel experiences to ensure that users can effortlessly interact with your application, irrespective of their device or preferred channel. 🌟📱

7️⃣ Data Management: The banking and insurance sectors deal with vast amounts of data. When modernizing, it’s crucial to adopt effective data management strategies. Employ data governance practices, establish data quality controls, and leverage data analytics to unlock actionable insights. Embracing technologies like data lakes, data warehouses, or real-time data processing frameworks can enable efficient data management and facilitate informed decision-making. 📊💡

Remember, legacy modernization is not a one-time project but an ongoing process. By considering these key factors during the design phase, you lay a strong foundation for building scalable architectures that empower your organization to thrive in the digital era. 🚀💼

I hope these insights help you understand the importance of designing scalable architectures for banking and insurance applications. Should you have any further questions or need more guidance, feel free to ask in the comments below or shoot us an email at “hi@itcrats.com”! 👨💻🔍